With summer in the UK truly over, Foresight Factory takes a look at Brexit’s impact on British tourism and travel, and where it’s headed in the years to come. And here’s a spoiler: it’s not as grim as you’d think.

Brexit can’t dampen British consumers’ travel habits

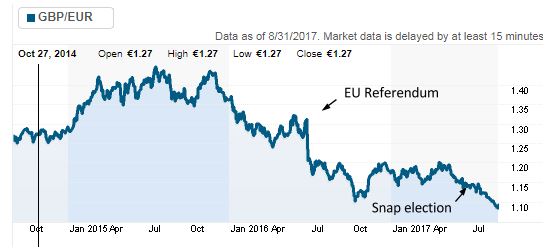

2017 was predicted by some to be the year of the staycation – with the falling pound and the promise of rising inflation, many reports anticipated that UK consumers would shun holidays abroad in favour of domestic trips. And according to Visit Britain, we’ve seen a growth in this – from January to April, domestic holidays were up 3% compared to the year before. This boost in domestic travel has been linked to the plummet of the pound against the Euro, after the announcement of the outcome of the EU referendum.

On the other hand, we can’t ignore the numbers from the Office for National Statistics (ONS), which reports that nine out of ten holidays taken by British tourists last year were in Europe – even in spite of the drop in the pound making these vacations that little bit more expensive. This reveals that forecasters championing staycations have forgotten about an obvious obstacle – the weather.

How the fallen £ affects travel

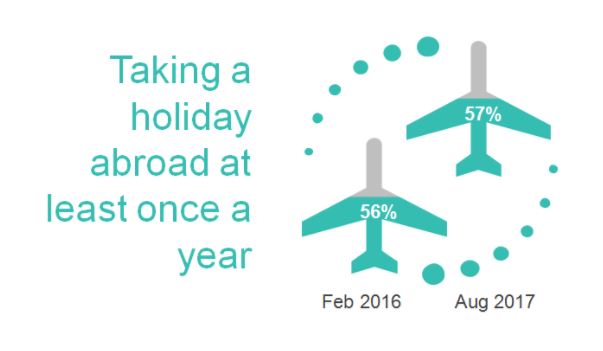

So just how important are exchange rates to British consumers? Despite the drastic decimation of the British pound shown in the chart above, there has been a lag in its effect on tourism. In part, this may have to do with the timing of the referendum in June 2016. Consumers typically book their holidays in advance, hoping to catch a better price, meaning that when the outcome was announced and the pound sterling dropped, flights and hotels were already paid for. There was no turning back despite the hike in what the holiday would have originally cost. More significantly, we found in our most recent wave of research (August 2017) that consumer intention to travel at home or abroad remained remarkably stable both before and after the referendum.

British consumers won’t compromise their sun tans

To answer the looming question of “what happens after Brexit?” – in light of concerns around visas and the cost of flights – travel abroad is unlikely to falter in favour of staycations. Budget airlines such as Ryanair carry on hawking their low-cost airfares, inspiring customers to take advantage of the deals. Furthermore, the ONS shows a longer term trend of growth in trips abroad made by UK residents, which had been dampened by the recession and has now finally recovered.

Why? Because for British consumers, taking regular holidays abroad is normalised behaviour, facilitated by years of price cutting wars by low-cost airlines. Then there’s the love of sunshine, which is one of the top three things that Brits look for from a holiday. So far, it would seem that British consumers are willing to pay a premium for at least one trip a year with guaranteed sunshine. For those looking for more cost effective ways to unwind and relax, we expect a shift to cheaper destinations, perhaps hopping over the Eurozone altogether, or more Maximising Behaviour – pre-planning and deal hunting in order to spend less when in destination. They certainly won’t be giving up their sun tans in favour of their native gloomy climate. So unless trip prices or unemployment unexpectedly rocket, short domestic trips won’t replace longer sunny holidays any time soon.

How should brands respond?

Millennials are still interested in travelling abroad, motivated by the connotations of self-discovery, not to mention the social currency associated with a great story to tell from a foreign destination. Brands could take a cue from AirFrance, which have launched a Millennial-focused airline Joon, which notably does not market itself as “budget” at all. Targeting a niche and adjusting messaging to fit the lifestyles of your target group can be effective, as we know consumers are more likely to recommend a brand that reflects their personality/tastes.

Beyond sunshine, other strong incentives to take a holiday are to relax and spend time with family. Brand marketers can look to tap in on our trend Pursuit of Real and create narratives about authentic experiences that can be shared with loved ones, which could appeal to those even on a budget. And as for luxury experiences, we’ve seen innovations on the rise that emphasise slow travel and the immersion and exploration of a new place.

However, as we found in our research, business as usual has been effective. Brands that can prove that they are good value with stable pricing will continue to attract business. Especially as consumers’ purchasing power decreases, they will be looking for travel companies with reliable pricing when they need to top up their vitamin D.